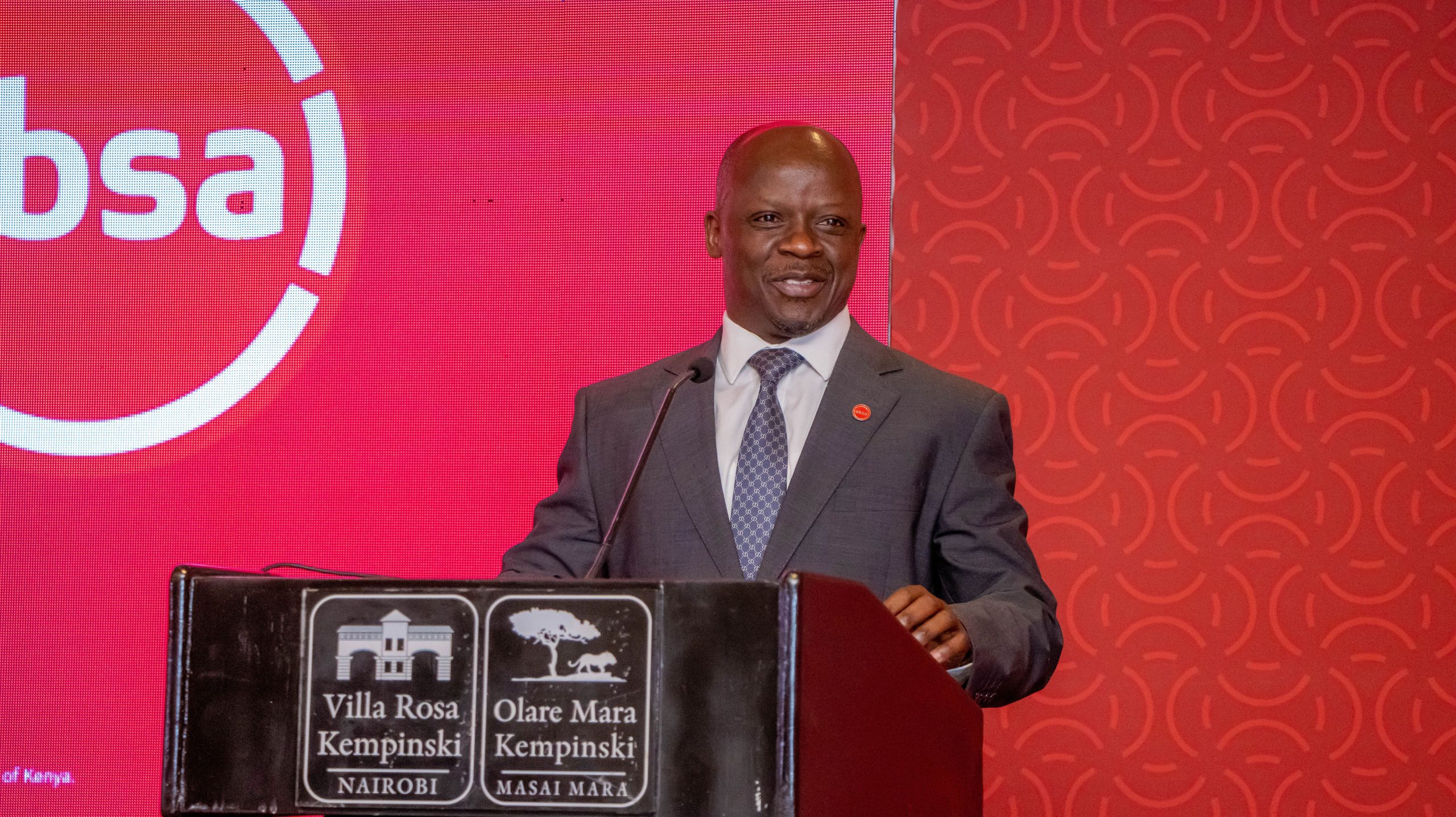

Absa Banks Timiza product is grabbing market share growing almost 40 percent in the value of loans issued out last year according to Safaricom results issued last week.

Absa bank has issued Kes22.4 billion via Safaricom’s ubiquitous mobile money growing faster than any other product on M-Pesa.

Absa Bank is coming late to the party with the sector dominated by Fuliza an overdraft product partnership between Safaricom and Banking rivals KCB Group and NCBA.

Veterans

The two lenders also operate loan products on Safaricom’s Mpesa ecosystem with KCB –Mpesa and MShwari owned by NCBA.

Although Fuliza had disbursed Kes833 billion by March 2024, its market size had only grown 18.9 percent from a similar period last year, while its closest competition M-Shwari grew 12.6 percent to103 billion.

KCB Mpesa grew 11.2 percent to Kes46.9 billion.

Fuliza for SME

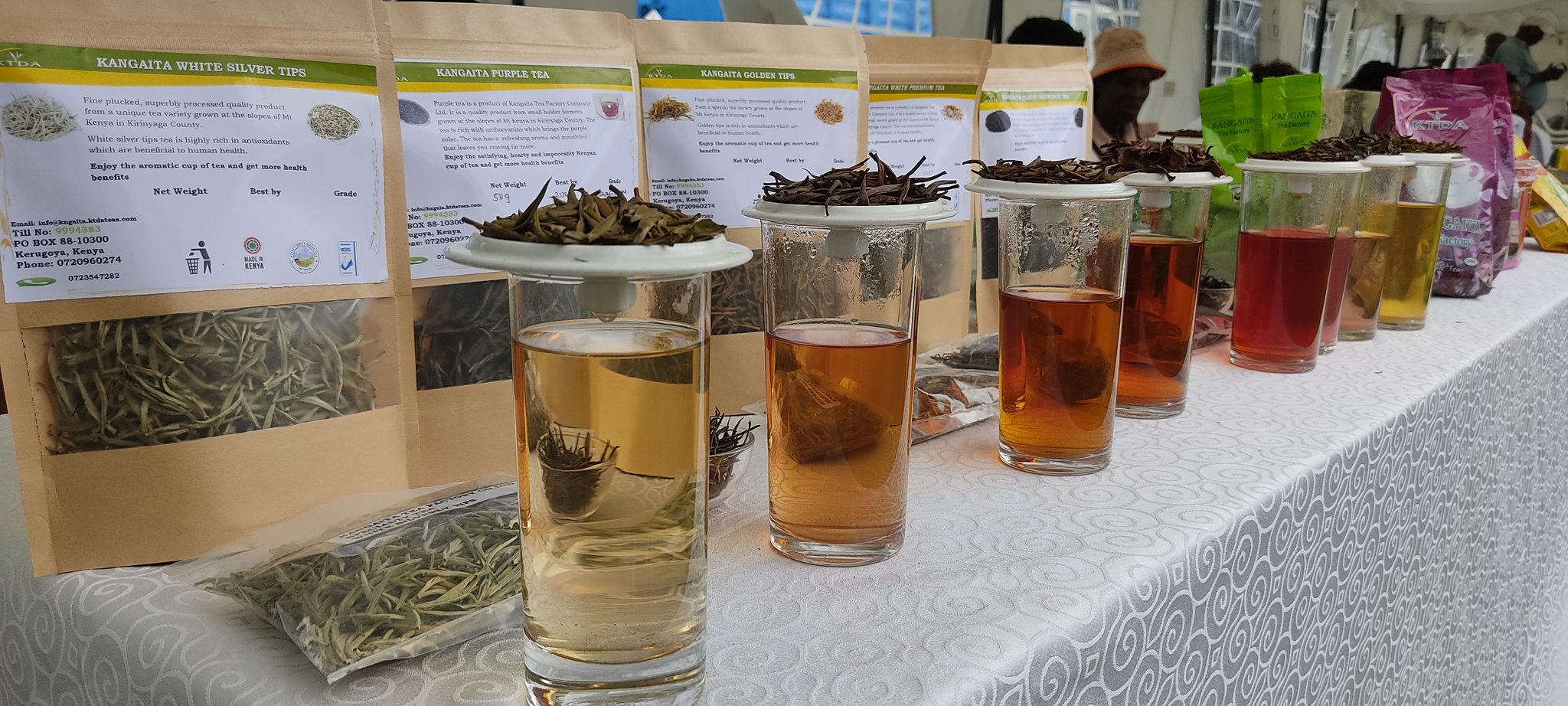

Safaricom’s new overdraft for merchants disbursed Kes32.5 billion in its first full year of operations, making a powerful market grab as the company converts small business seeking payments solutions into loan customers.

Safaricom on May 4 announced partnership with KCB Bank Kenya to rollout Fuliza ya Biashara, a service allowing business owners to access unsecured credit by overdrawing on M-Pesa business tills to cover short-term cash flow shortfalls.

The partnership demonstrates the huge potential of targeting merchants and businesses with cash flow loans facilitated by visibility through digital payments provided by the telco and banks.

Banks are taking over the digital lending space as the Central Bank of Kenya tightens controls locking out fringe tech players. The rise of Absa bank in digital lending space signals rising competition that may benefit consumers with better terms for mobile loans that tend to be expensive and short term.

New strategy

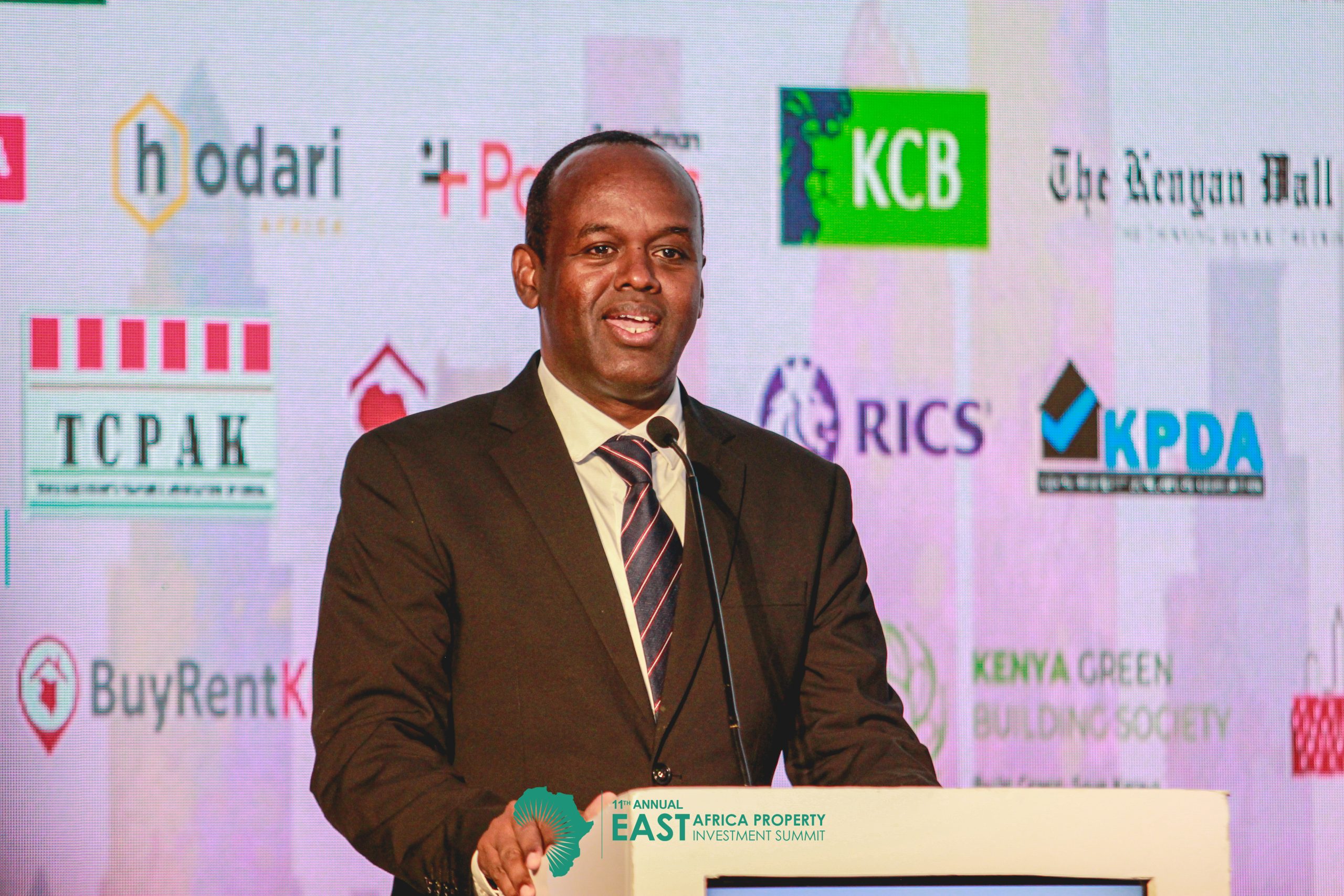

After rebranding to Absa Bank, formerly Barclays has taken up a new strategy focused on growing market share.

Under the Absa brand, the Bank has taken a new strategic direction growing what it calls Africanacity, investing in African stories to weave itself into the brand of choice for Africa’s largely youthful population.

While previously it was curtailed by global bureaucracy from playing in the retail and small business mobile lending space, once the UK bank decoupled from Africa leaving the business under South Africa headquartered Absa Group the bank has made strides in this space.

Absa Bank Kenya is already expanding its footprint as a result targeting Small and Medium Enterprises (SMEs) with tailor made financing offers like unsecured business loans of up to Sh10 million, LPO financing of up to Sh12 million, unsecured invoice discounting of up to Sh50 million and unsecured bid bonds of up to Sh10 million.

The lender has also cut the time it takes to secure a loan for SMEs to 48 hours where women owned businesses will be able to secure Sh3 million facilities form its Sh10 billion in the Wezesha Biashara programme.

Absa bank also relaxed the process of application to its customers and through their Timiza mobile App, where SMEs could access loans through mobile phones where it offered borrowers friendlier terms and higher loan limits in a package that also seeks to cross-sale insurance and savings.

Following regulatory clamps on the digital lending space, Banks have made a lot of progress in taking over market share through their own offering and in partnership with telco Safaricom.

Discover more from Orals East Africa

Subscribe to get the latest posts sent to your email.